Annual Income Meaning Uk

According to the Annual Survey of Hours and Earnings ASHE 2019 median weekly earnings for full-time employees rose by 29 between April 2018 and April 2019 reaching 585. For example someone with a gross annual income of 100000 and a tax rate of 25 would have a net annual income of 75000.

The Difference Between Gross And Net Pay Economics Help

Total Annual Income For an individual or business with multiple income streams or sources of earnings their total annual income will be equal to the sum of all the income sources.

Annual income meaning uk. Youll need to provide your household income for tax year. This amount must be figured to calculate annual taxes to be paid. Clark Apr 29 2021 The average annual total income per household of those in the top decile group amounted to approximately 186 thousand British pounds.

Gross annual income is the sum of all income received from different sources during the calendar year that means from January 1 to December 31. Depending on the data that is required to determine your annual income you may base your income on either a calendar year or a fiscal year. Their yearly survey showed that the average salary in the UK for men and women combined was 29009 which includes those in both full-time and part work.

In a company it is calculated as revenues minus expenses. Annual income is the total income that you earn over one year. Annual income is usually taxed by the government though ones taxable income for a year may differ from hisher actual annual income.

Annual income can be expressed as a gross figure or a net figure. Household income as defined by the US. For individual income it is calculated as the individuals wages or salary investment and asset appreciation and the amount made from any other source of income.

The formula for the annual income is. The average UK annual salary or weekly wage of full-time employees differs drastically across industries. Annual income hourly wage hours per week weeks per year If you want to do it without the yearly salary income calculator substitute your numbers into this formula.

Published by D. Annual gross income or AGI is sometimes confused with net annual income. Improve your vocabulary with English Vocabulary in Use from Cambridge.

The total amount of a persons or organizations income in a one-year period before tax is paid on it. Want to learn more. Her gross annual income was 50000.

Receiving income is the goal of all commerce. Meaning of earnings For tax purposes the word earnings in relation to an office or employment means. For example Sarah works part-time at Online Co earning 32000 per year and also.

The ethnicity pay gap headline measure uses Annual Population Survey APS data and is calculated as the difference between the average hourly earnings of. For those in full-time work the average UK salary is 35423 and 12083 for those in part-time. Median income between the financial year ending FYE 2019 April 2018 to March 2019 and FYE 2020 April 2019 to March 2020 remained broadly unchanged at.

Also it is a measure employed by banks and other financial institutions to assess an individuals ability to pay for his. An individual who is not UK domiciled is liable to capital gains tax CGT on gains arising outside the United Kingdom only to the extent that those gains are remitted to the United Kingdom. Non-UK source investment income receivable by a non-UK domiciled individual is taxed only if remitted to the United Kingdom.

2019 to 2020 if youre applying for the 2021 to 2022 academic year. If youre still confused about how to find annual income have a look at the examples. A calendar year is January 1st to December 31st of the same year.

An individual or companys income before taxes and deductions. Census Bureau refers to the combined gross cash income of all members of a household defined as a group of people living together who are 15 years or older. Annual Income The money a person makes from labor investment or any other source in the course of a year.

Any salary wages or fee any gratuity or other profit or incidental benefit of any kind. This was much larger than. 2018 to 2019 if youre applying for the 2020 to 2021 academic.

While AGI is the amount of money you receive in a fiscal year your net annual income is the amount left after taking deductions into account.

When A Job Offer In The Uk Mentions A Salary Is It Net Or Gross When Not Specified Quora

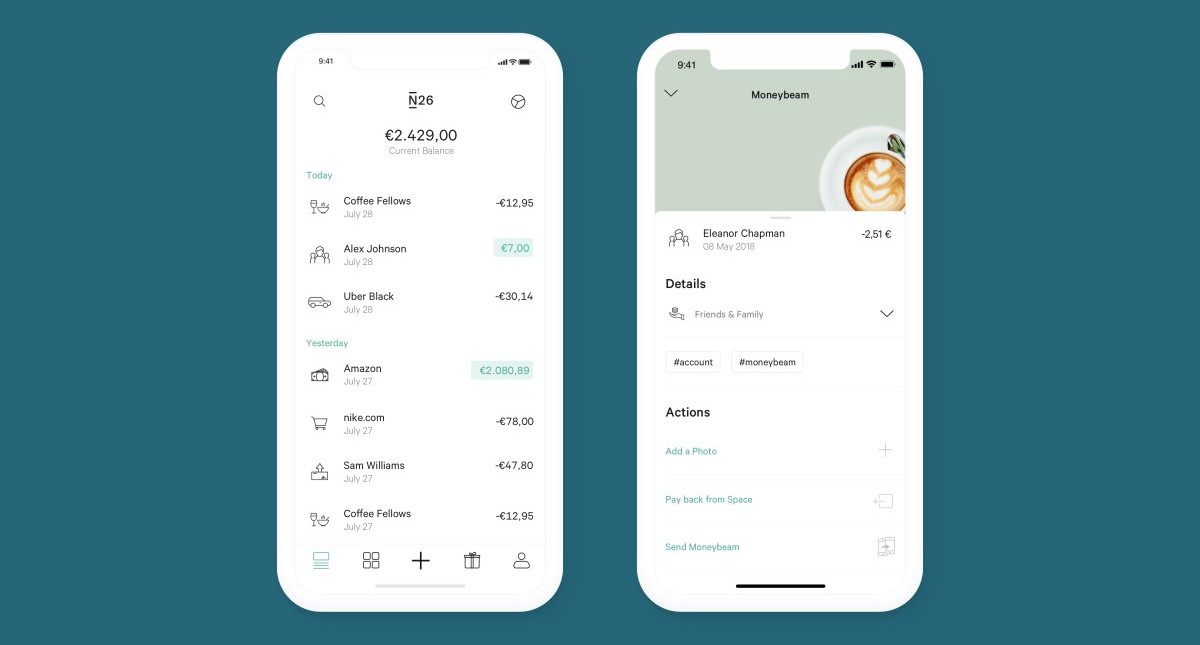

Base Salary Explained A Guide To Understand Your Pay Packet N26

What Income Level Is Considered Rich Financial Samurai

3 Ways To Calculate Your Hourly Rate Wikihow

Annual Income Learn How To Calculate Total Annual Income

20 000 After Tax 2021 Income Tax Uk

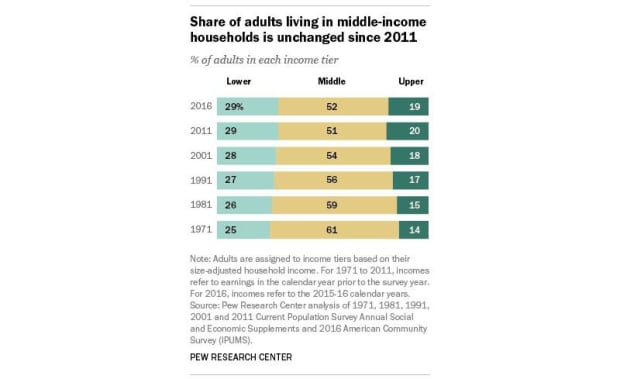

What Is The Middle Class Income And Range Thestreet

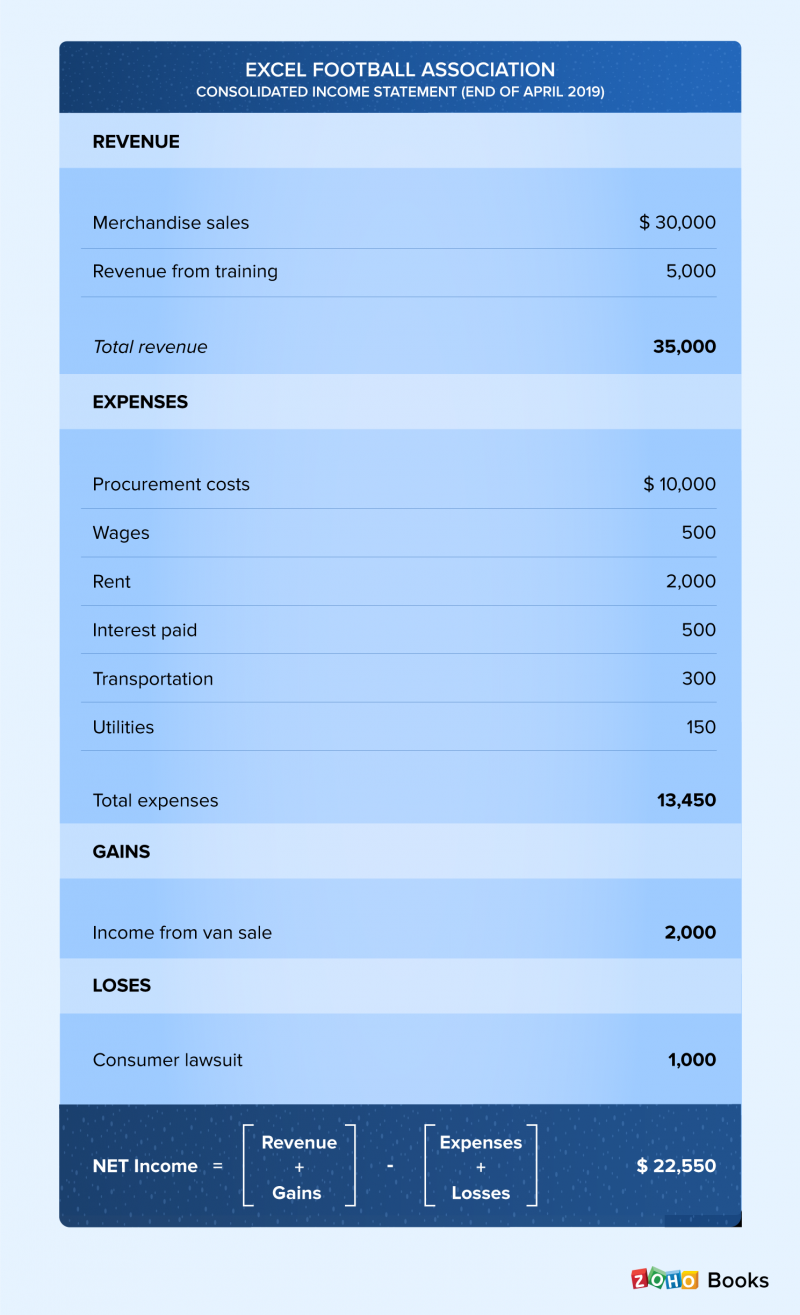

What Is Income Statement Definition Example Format Of Income Statement Zoho Books

What Income Level Is Considered Rich Financial Samurai

Uk Doctors Salary And Satisfaction Report 2019

Base Salary Explained A Guide To Understand Your Pay Packet N26

Gross Income Definition Formula Examples

4 Ways To Calculate Annual Salary Wikihow

The 1 10th Rule For Car Buying Everyone Must Follow

What Is The Average Ux Designer Salary 2021 Guide

What Income Level Is Considered Rich Financial Samurai

Base Salary Explained A Guide To Understand Your Pay Packet N26

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

Post a Comment for "Annual Income Meaning Uk"