Salary Meaning For Pf Calculation

Kapish Saluja Labour Law Consultant Mumbai. This amount earns interest and you can use it to finance a part of post-retirement life or other goals.

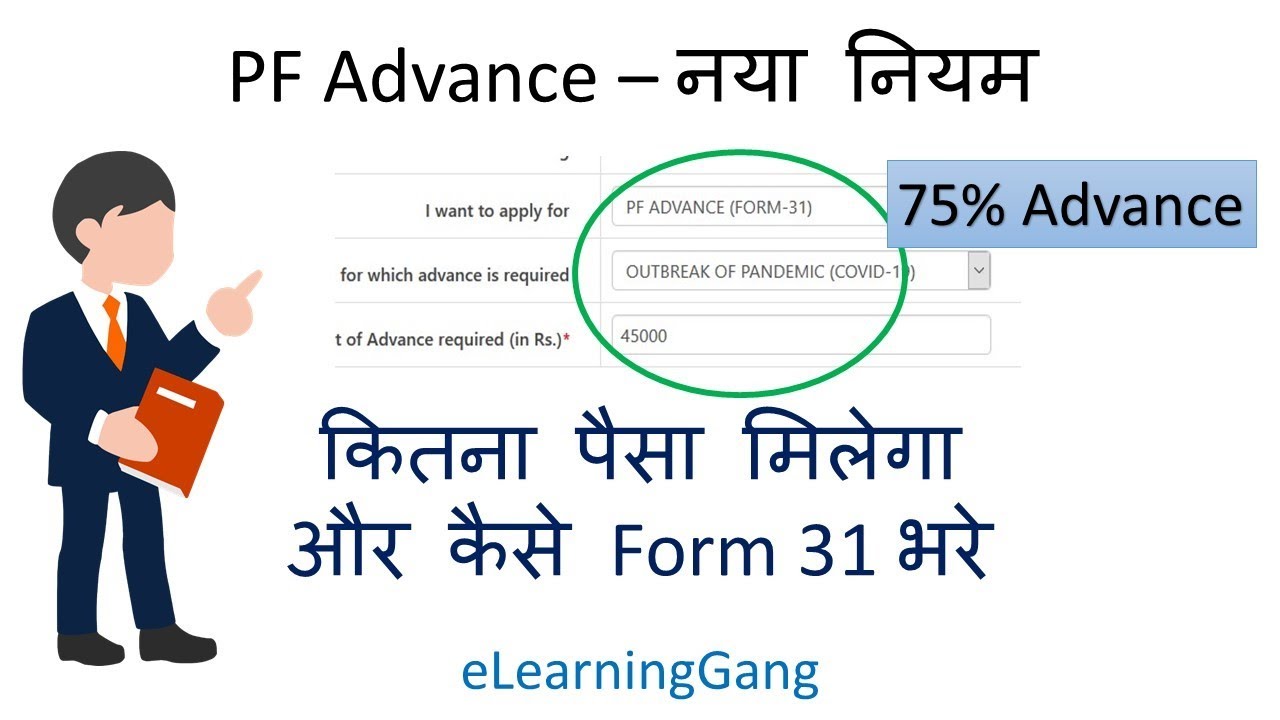

Pf Advance Withdrawal Form 31 Epfo New Rule How To Withdraw Pf Advance Epf Withdrawal Online Youtube

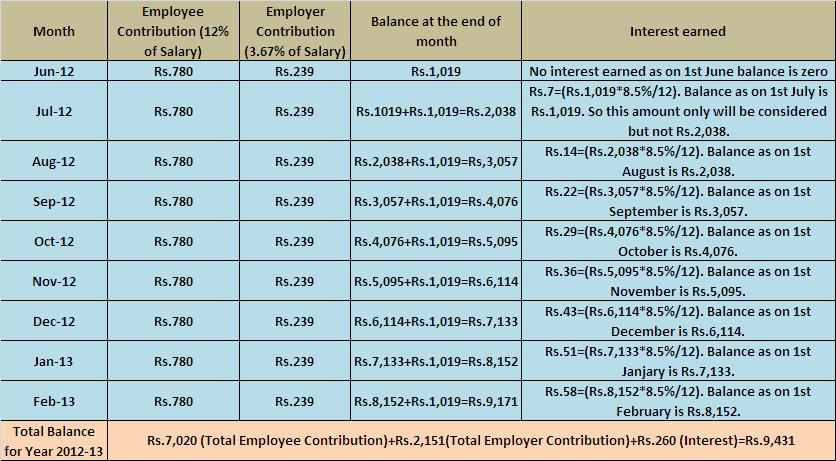

So total employee will contribute 12 of basic wage DA for PF and employer will pay 13 towards employee PF and pension accounts together.

Salary meaning for pf calculation. If there is no DA then only basic wage is considered to calculate the EPF monthly contributions. For example if the PF Gross is Rs 2000 per month and the minimum wages is Rs 3000 the PF department may not accept the PF calculation and. Some for the popular or common allowances in the bifurcation of emoluments are special allowanceHouse Rent Conveyance City Compensatory Education Leave Travel.

For employees whose salary is above 15000 then the PF contribution is calculated up to 15000 only. But from now onwards it includes BasicDAAllowances. If the amount of the gross salary and net salary is almost equal then it means that the income tax levied is.

Calculation of gratuity not covered under the payment of gratuity act. Gratuity can also be calculated. Annual accretion to the balance of Recognized Provident Fund.

Salary for PF calculation should not be less than minimum wages The PF department by way of a circular has stated that the salary for the purpose of PF calculation should not be less than the minimum wages specified by the Minimum Wages Act. For example if the PF Gross is Rs 2000 per month and the minimum wages is Rs 3000 the PF. Transferred balance in Recognized Provident Fund.

Wages or Salaries are emoluments earned by an employee. If employee wants to contribute more amount then he can contribute under voluntary PF contribution but employer doesnt have any obligation to calculate PF contribution on increased salary. 2BasicDAall other allowances excluding HRA 3BasicDA only like in calculating pf conribution of 12.

It is paid either as a consolidated wage or bifurcated into various Allowances. Dear Nitya Wages for calculation of PF 12 of BasicDARARetention allowance to the maximum of Rs6500- 7th October 2010 From India Mumbai. So your total salary from above example will be Rs46000.

Employee Provident Fund EPF is a scheme in which you as an employee at a government or private organisation can create wealth through your working years. Salary for PF calculation should not be less than minimum wages In a recent circular the PF department has stated that the salary for the purpose of PF calculation should not be an amount which is less than the minimum wages as specified by the Minimum Wages Act. In a recent ruling that favours employees the Delhi High Court has expanded the scope of basic wages to be included for Provident Fund PF contribution.

The salary for the purpose of calculation of income from salary includes. Previously as the meaning of salary was only BasicDA so 12 of Rs30000Rs3600 was considered for EPF payout from your end and equally from your employer end too. ESI Calculation Formula Percentages 2021.

Meaning of net salary. There are three rules for PF calculations 1 12 of your basic salary 2 12 of your basic salary and capped at 1800-3 12 of PF your gross-HRA and capped at 1800-Please check your PF calculations as per above rules to get correct PF amount. Salary for PF calculation should not be less than minimum wages In a recent circular the PF department has stated that the salary for the purpose of PF calculation should not be an amount which is less than the minimum wages as specified by the Minimum Wages Act.

Examples of basic monthly salary Grades Basic monthly salary at step 1 in as of 01072019 Grades Basic monthly salary at step 1 in as of 01072019 AST 1 297973 AD 5 488311 AST 2 337137 AD 6 552491 AST 3 381447 AD 7 625108 AST 4 431585 AD 8 707270 AST 5 488311 AD 9 800230. The gross salary is the actual salary that was promised to the employee but the net salary is the one that is being paid to him. 14 May 2011 Apart from Basic Salary Dearness Allowances variable according to changes in cost of living index or fixed as a percentage of basic pay and Retaining allowances allowances paid to employees to retain his skill especially when there is no work due to any reason are part of salary for the purpose of EPF contribution.

Meaning of Salary. May I know which of the below I should take for calculating the cutoff of Rs15k for deciding who falls in the PF net. Fees Commission Perquisites Profits in lieu of or in addition to Salary or Wages.

In this scheme both you and your employer make contributions towards your EPF. If the salary structure does not include any DA but includes. Salary Definition for Calculation of GratuityHRA EPF Leave Encashment Calculation of gratuity covered under the payment of gratuity act.

For the calculation of gratuity salary includes only. 1BasicDAHRAall other allowancesGross salary. Net salary is said to be the physical amount that the employee gets his hands on and is exclusive from other fringe benefits.

Contribution to EPF will be 12 of Rs46000 which is Rs5520.

Download Salary Breakup Report Excel Template Exceldatapro Payroll Template Breakup Excel Shortcuts

Pf Admin Charges Calculator 2021 How To Calculate Pf Admin Charges

Pf Calculation On Salary How Epf Is Calculated Abc Of Money

Legalresolved Pf Withheld By Employer And What You Can Do Savings Account Financial News Fund Accounting

Employee Provident Fund Epf Changed Rules From 1st Sept 2014 Sap Blogs

Epf Interest Rate 2020 21 How To Calculate Interest On Epf

How To Calculate Provident Fund Calculator Galaxy Phone

Epf Member Portal Online Epfo Portal Login For Employees Online Portal Members

All Employee Provident Fund Questions Answered

Pf Calculation On Salary How Epf Is Calculated Abc Of Money

Epf Challan Calculation Excel 2021

Rules For Esi And Pf Deduction To Calculate Employee Employer Contribution

How Epf Employees Provident Fund Interest Is Calculated

Is It Mandatory To Deduct Pf From Salary More Than 15000

Pf Esi Calculation Excel Format 2021 Download

Pf Electronic Challan Cum Return Version 2 0 Hinote Systems Outsourced Payroll Services Online Payroll Software

What Is Pf Know Pf Meaning Benefits Rate Of Interest Karvy Corporate

How To Calculate Pf And Esi With Example In 2018

Post a Comment for "Salary Meaning For Pf Calculation"