Monthly Income Calculator Quebec

Each portion of your homes value is taxed at its own unique marginal tax rate. You can check the latest.

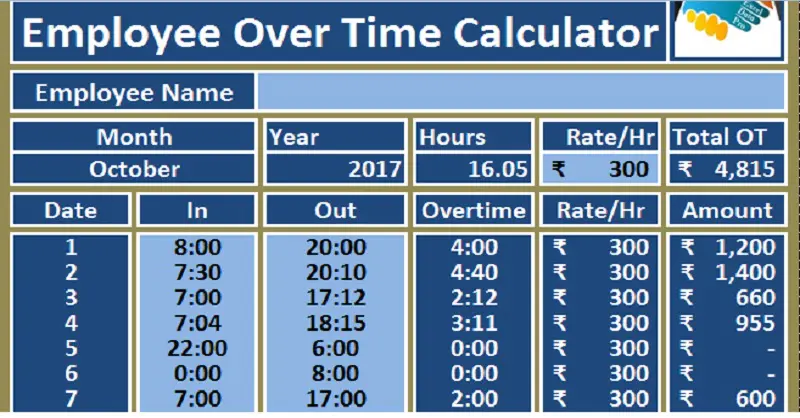

Download Employee Overtime Calculator Excel Template Exceldatapro

This usually happens in late January.

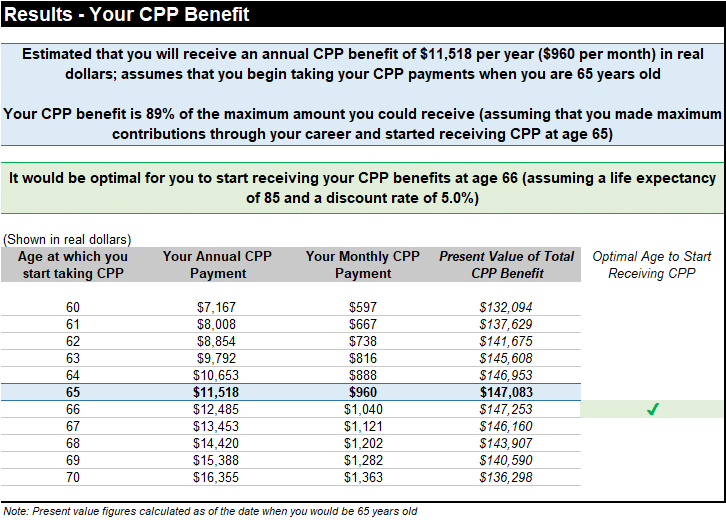

Monthly income calculator quebec. Do you want to deduct. Our retirement calculator takes into account the average Canadian retirement income from the Old Age Security OAS and Canada Pension Plan CPP for 2018. This tool assumes a monthly CPPQPP payment of 600 in retirement to start indexed to inflation.

The CPPQPP ensures a basic income for retired workers. What type of Plan do you have. The calculator will show your tax savings when you vary your RRSP contribution amount.

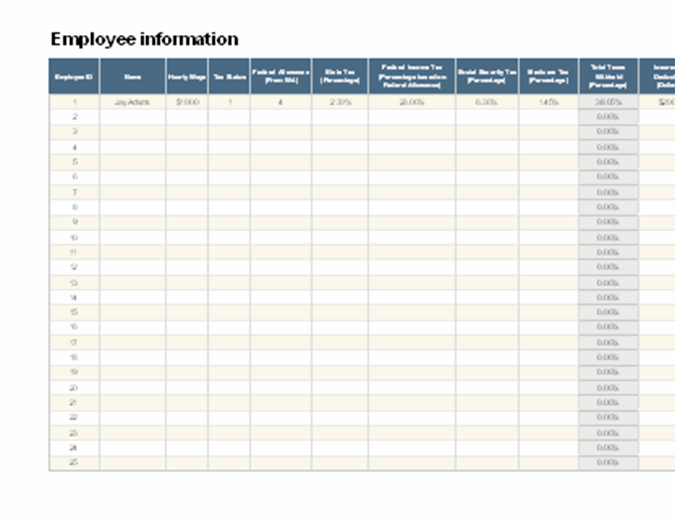

Tell us about yourself so we can give. The amount can be hourly daily weekly monthly or even annual earnings. Accountants bookkeepers and financial institutions in Canada rely on us for payroll expertise and payroll services for their clientele.

What can affect your CPPQPP income. The tax calculator is updated yearly once the federal government has released the years income tax rates. 500020000 Final Expenses.

Registered Retirement Savings Plan RRSP A Registered Retirement Savings Plan RRSP is a personal savings plan registered with the Canadian. To get the most accurate result make sure to indicate all of the figures for your monthly expenditures. Quickly estimate the minimum monthly and annual income withdrawal you could receive from your RRIF after you have converted your RRSP.

Take 2 minutes to get your results. Income from line 150 of your income tax return. Gross Rental Income Monthly Rent 12 months 1 - Vacancy Rate100 The vacancy rate is the amount of time your property is empty and not making money.

Usage of the Payroll Calculator. The calculator is updated with the tax rates of all Canadian provinces and territories. Tell us about yourself.

Many things can affect your CPPQPP pension. CPPQPP is based on how much and for how long you contributed to the plan and the age at which you choose to start your CanadaQuebec pension payments. The default value in the calculator is the 2019 maximum monthly payment regardless of your marital status.

The calculator helps determine how much you can afford based on your yearly incomealong with the income of anyone else purchasing a home with you and your monthly expenses. Canada Income Tax Calculator for 2020 2021. Trusted by thousands of businesses PaymentEvolution is Canadas largest and most loved cloud payroll and payments service.

Enter your pay rate. A funeral can cost anywhere from 5000 to 20000 or more depending on whether you plan for cremation or burial and how expensive your choices are coffin location etcIn addition you should consider expenses such as probate fees final income taxes legal and accounting fees and executor fees if any. To begin answer the following questions.

Personal Income Tax Calculator - 2020 Select Province. You can use the calculator to compare your salaries between 2017 2018 2019 and 2020. The first affordability guideline as set out by the Canada Mortgage and Housing Corporation CMHC is that your monthly housing costs mortgage principal and interest taxes and heating expenses PITH - should not exceed 32 of your gross household monthly income.

All income projections and contributions assume an inflation rate of 2 per year. Enter Canadian dividends Enter Eligible dividends Enter self-employment income. The Net Rental Income is your Gross Rental Income after taking into account the operating expenses of owning a.

In Montreal there are additional tax brackets from 258600 to 517100 with a tax rate of 15 and from 500001 to 999999 with a tax rate of 20 and finally for amounts over. The sum of these. Is this a Canadian retirement income calculator.

Period of Cohabitation The. Youll need to input how much you extra. Find your average tax rate and how much tax you will have to pay on any additional income.

Also includes half of your monthly condominium fees. WOWA Trusted and Transparent. This tool assumes a monthly OAS pension of 570 in retirement to start indexed to inflation.

This calculator estimates after tax income based on gross income and provincial residence applying common tax credits and deductions. If you have paid into the CPPQPP you are entitled to receive a monthly pension payment as early as age 60 or as late as age 70. Simplepay Tax Calculator is a free online tool to calculate Canada Payroll taxes and print cheques.

Our Mortgage Affordability Calculator applies the federal lending rules most lenders use in assessing mortgage. It assumes all income is employment income ie. Fidelitys tax calculator estimates your year-end tax balance based on your total income and total deductions.

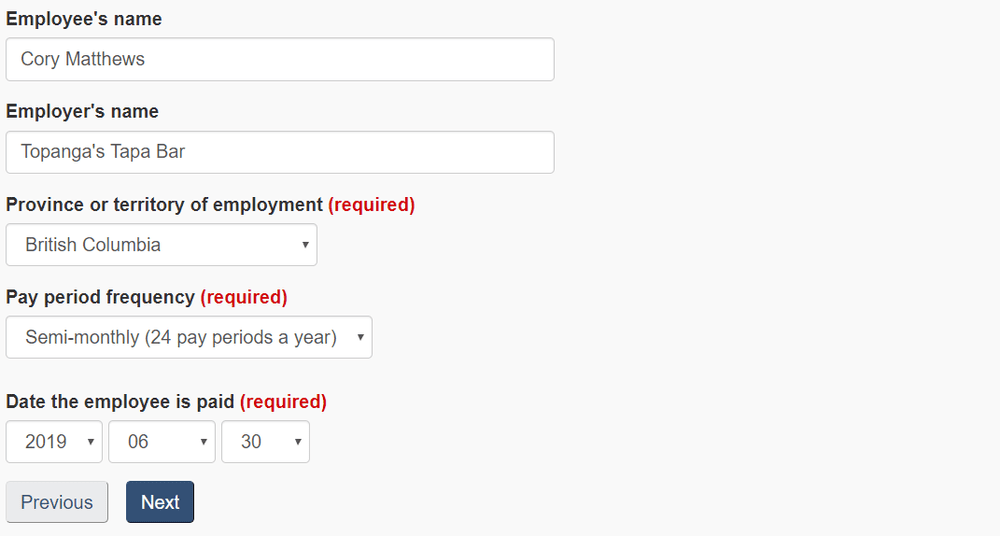

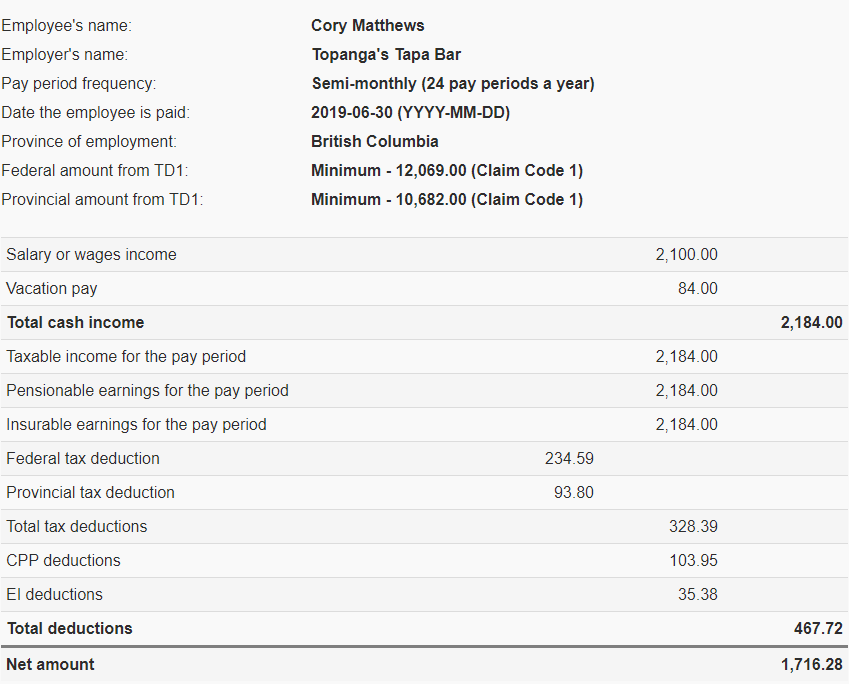

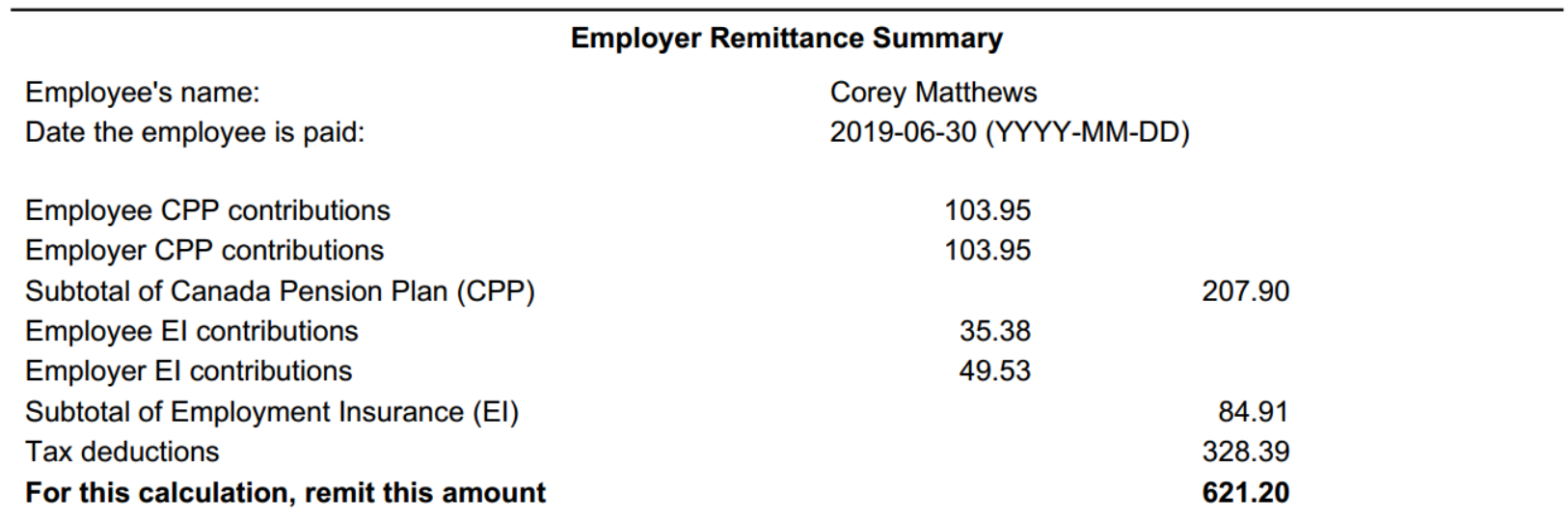

Final expenses to pay for funeral taxes etc. On the Salary pay calculation andor on the Commission pay calculation screen go to Step 3 and select the CPP Exempt andor EI Exempt option before clicking on the Calculate button. To determine the amount of tax to deduct from income not subject to CPP contributions or EI premiums use the Payroll Deductions Online Calculator available at canadacapdoc.

Estimate your 2020 2021 total income taxes with only a few details about your income and province. It will also help you estimate your monthly CPPQPP income. Tell us about yourself.

Another way to think of vacancy rate is the amount of time your property is making money which is 100 - Vacancy Rate. Threshold Maximum Rate Cut-off CPP. 85636 158 54200 Net take-home.

Quebecs Land Transfer TaxLTT is a percentage of your homes purchase price and has a marginal tax rate ranging from 05 to 15. Enter RRSP Contributions Total income. Simplepay includes Direct Deposit Electronic Remittances Statutory Holiday Calculator Timesheets Custom Earning Deductions General Ledger Import All CRA forms T4T4ARL1ROE.

Monthly a month 12 periods per year Semimonthly 2 x per month 24 periods per year Biweekly every 2 weeks 26 periods a year weekly once per week 52 periods a year Schedule per hour 52 weeks x number of hours per week Our calculator allows you to evaluate the grossnet salary over the period based on the number of weeks worked that you entered in the field weeks of work. ESG Explained is a collection of short-form whitepapers that provide an in-depth look into responsible investing 1. 350000 289800 525 58700 2018 525 EI.

Calculate CPP EI Federal Tax Provincial Tax and other CRA deductions. This calculator will help you understand the factors that can affect your Canada Pension Plan CPP or Quebec Pension Plan QPP. Calculations will not be as accurate for other types of income as different tax considerations apply.

How To Calculate Net Income 12 Steps With Pictures Wikihow

How To Calculate Your Monthly Car Payments

How To Calculate Net Income 12 Steps With Pictures Wikihow

Monthly Loan Amortization Schedule Excel Template Amortization Schedule Excel Templates Loan Calculator

Loan Amortization Schedule Simple Amortization Schedule Mortgage Amortization Refinance Mortgage

Dividend Income June 2016 Update Tawcan Dividend Income Dividend Income

Money Saving Meals Finance Business Case Template Business Plan Template Statement Template

What Motor Vehicle Expenses Can You Claim On Income Tax In Canada Income Tax Tax Motor Car

How To Calculate Net Income 12 Steps With Pictures Wikihow

How To Use The Cra Payroll Deductions Calculator Avalon Accounting

Home Ownership Expense Calculator What Can You Afford

How To Calculate Amortization Amortization Schedule Interest Calculator Amortization Chart

How To Use The Cra Payroll Deductions Calculator Avalon Accounting

Payroll Tax Prep Tax Preparation Payroll

Loan Amortization Calculation Emi Principal And Interest Components Homeloan Interest Calculator Mortgage Amortization Mortgage Amortization Calculator

How To Use The Cra Payroll Deductions Calculator Avalon Accounting

Post a Comment for "Monthly Income Calculator Quebec"