Monthly Income Calculator Post Tax

Why not find your dream salary too. This means that after tax you will take home 2570 every month or 593 per week 11860 per day and your hourly rate will be 1923 if youre working 40 hoursweek.

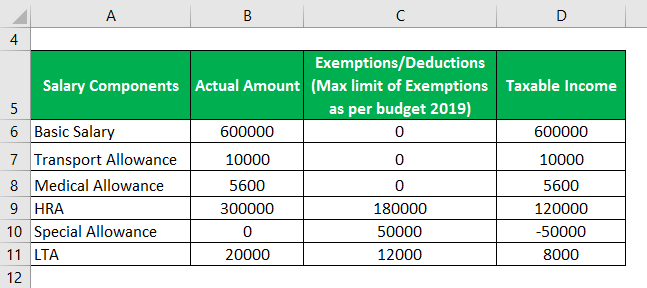

Taxable Income Formula Calculator Examples With Excel Template

The latest budget information from April 2021 is used to show you exactly what you need to know.

Monthly income calculator post tax. When calculating your take-home pay the first thing to come out of your earnings are FICA taxes for Social Security and Medicare. You can calculate your Monthly take home pay based of your Monthly gross income Education Tax NIS and income tax for 202122. If you make 55000 a year living in the region of Florida USA you will be taxed 9295.

This marginal tax rate means that your immediate additional income will be taxed at this rate. 19c for every dollar between 18201 - 0. Check your tax code - you may be owed 1000s.

Your employer withholds a 62 Social Security tax and a 145 Medicare tax from your earnings after each pay period. The Canada Monthly Tax Calculator is updated for the 202122 tax year. The money also grows tax-free so that you only pay income tax when you withdraw it at which point it has hopefully grown substantially.

No tax on income between 1 - 18200. For the 2020-2021 tax year the first 18200 you earn is tax-free. This marginal tax rate means that your immediate additional income will be taxed at this rate.

Marriage tax allowance Reduce tax if you wearwore a uniform. Your annual savings expected rate of return and your current age all have an impact on your retirements monthly income. Simply enter your annual or monthly income into the salary calculator above to find out how taxes in Ireland affect your income.

Retirement Income Calculator Canadian Use this calculator to determine how much monthly income your retirement savings may provide you in your retirement. Tax-free childcare Take home over 500mth. Your average tax rate is 220 and your marginal tax rate is 353.

Also known as Gross Income. Also explore hundreds of other calculators addressing topics such as tax finance math fitness health and many more. Anything you earn above 180001 is taxed at 45.

Use the simple monthly Canada tax calculator or switch to the advanced Canada monthly tax calculator to review NIS payments and income tax. Salary Before Tax your total earnings before any taxes have been deducted. About the Monthly Tax Calculator.

One can use the post office MIS calculator to calculate the monthly income from this investment. That means that your net pay will be 45705 per year or 3809 per month. Use the simple monthly tax calculator or switch to the advanced monthly tax calculator to review NIS payments and income tax deductions.

If you have HELPHECS debt you can calculate. You can calculate your Monthly take home pay based of your Monthly gross income and the tax allowances tax credits and tax brackets as defined in the 2021 Tax Tables. 11 income tax and related need-to-knows.

C for every dollar over 180000. For instance an increase of 100 in your salary will be taxed 3613 hence your net pay will only increase by 6387. These include Roth 401k contributions.

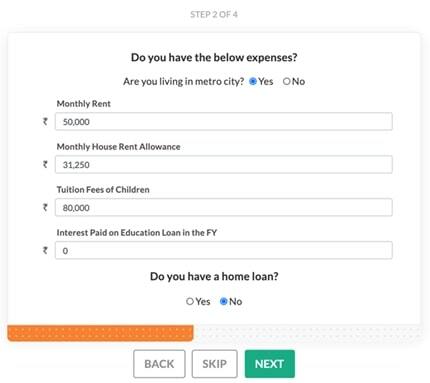

The Salary Calculator will also calculate what your Employers Superannuation Contribution will be. The calculator uses necessary basic information like annual salary rent paid tuition fees interest on childs education loan and any other savings to calculate the tax. Uniform tax rebate Up to 2000yr free per child to help with childcare costs.

Free tax code calculator Transfer unused allowance to your spouse. Hourly rates weekly pay and bonuses are also catered for. The post office monthly income scheme allows an investor to invest a lumpsum amount and earn a monthly income in the form of interest for five years.

Your average tax rate is 169 and your marginal tax rate is 297. Free calculator to find the actual paycheck amount taken home after taxes and deductions from salary or to learn more about income tax in the US. Find out the benefit of that overtime.

325c for every dollar between - 0. The Salary Calculator tells you monthly take-home or annual earnings considering UK Tax National Insurance and Student Loan. Your average tax rate is 222 and your marginal tax rate is 361.

37c for every dollar between - 180000. For instance an increase of 100 in your salary will be taxed 3527 hence your net pay will only increase by 6473. Some deductions from your paycheck are made post-tax.

Can be used by salary earners self-employed or independent contractors. This Australian Salary Calculator will show you what your weekly fortnightly monthly Income or Net Salary will be after PAYG tax deductions. Youll then pay 19 on earnings between 18201 and 45000 325 on earnings between 45001 and 120000 and 37 on earnings between 120001 and 180000.

The Indian Monthly Tax Calculator is updated for the 202122 assessment year. An income tax calculator is a tool that will help calculate taxes one is liable to pay under the old and new tax regimes. This marginal tax rate means that your immediate additional income will be taxed at this rate.

The money for these accounts comes out of your wages after income tax has already been applied. Youll then get a breakdown of your total tax liability and take-home pay. If you earn over 200000 youll also pay.

If your salary is 40000 then after tax and national insurance you will be left with 30840. To use the tax calculator enter your annual salary or the one you would like in the salary box above If you are earning a bonus payment one month enter the value of the bonus into the bonus box for a side-by-side comparison of a normal month and a bonus month. The interest rate for the quarter April-June 2020 is 66.

Income Tax Formula Excel University

Online Income Tax Calculator Calculate Income Taxes For Fy 2020 21 Scripbox

How To Create An Income Tax Calculator In Excel Youtube

Paycheck Calculator For Excel Paycheck Consumer Math Salary Calculator

Income Tax Calculator Calculate Income Tax Online Fy 2020 21

How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel

Online Income Tax Calculator Calculate Income Taxes For Fy 2020 21 Scripbox

How To Calculate Net Income Formula And Examples Bench Accounting

Annual Income Learn How To Calculate Total Annual Income

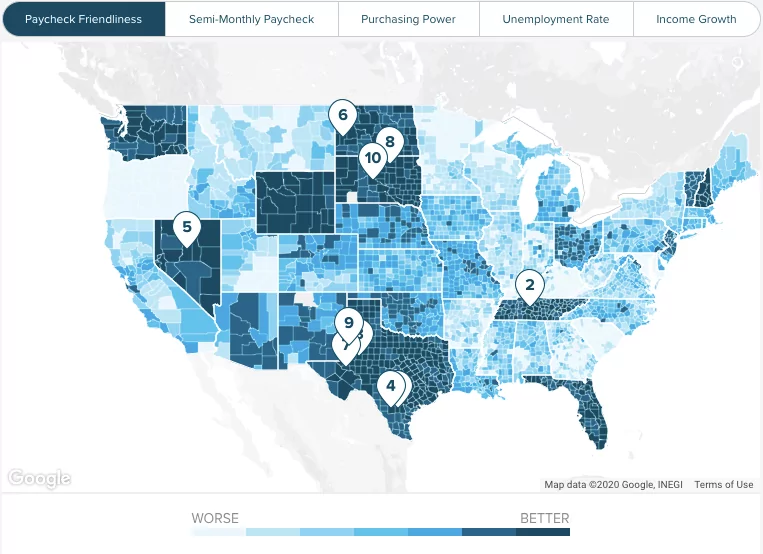

Texas Paycheck Calculator Smartasset

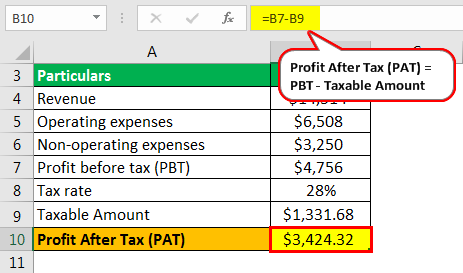

Profit After Tax Definition Formula How To Calculate Net Profit After Tax

Taxable Income Formula Calculator Examples With Excel Template

Taxable Income Formula Calculator Examples With Excel Template

Income Tax Formula Excel University

Income Tax Formula Excel University

Different Types Of Payroll Deductions Gusto

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

Post a Comment for "Monthly Income Calculator Post Tax"