Monthly Income Calculator Usa

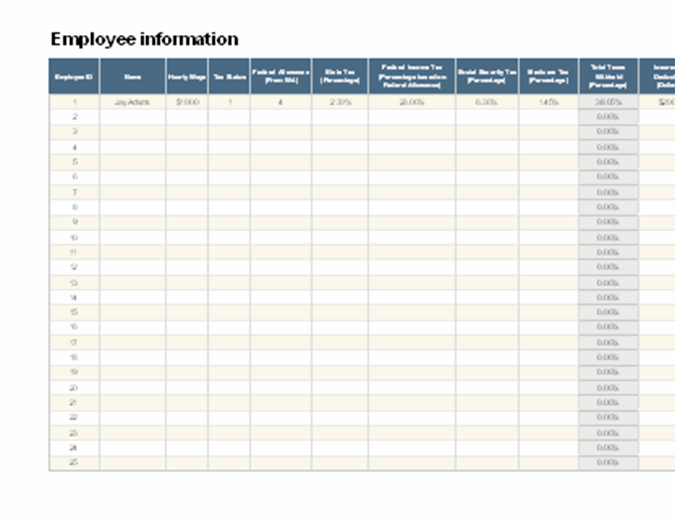

ICalculator provides the most comprehensive free online US salary calculator with detailed breakdown and analysis of your salary including breakdown into hourly daily weekly monthly and annual pay and tax rates. If you are filing taxes and are married you have the option to file your taxes along with your partner.

Comparison Of Uk And Usa Take Home The Salary Calculator

Our calculator has recently been updated in order to include both the latest Federal Tax Rates along with the latest State Tax Rates.

Monthly income calculator usa. 200 rows The Wage and Salary Conversion Calculator is used to convert a wage stated in one. Use our VA home loan calculator to estimate payments for a VA loan for qualifying veterans active military and military families. If you are paid an even sum for each month to convert annual salary into monthly salary divide the annual salary by 12.

Your average tax rate is 222 and your marginal tax rate is 361This marginal tax rate means that your immediate additional income will be taxed at this rate. Enter age and pre-tax gross income earned in full-year 2019 to compare to income distribution by age. 10562413041 Income Calculation Guide.

Multiply your annual salary by 036 percent then divide the total by 12. Next select the State drop down menu and. Determining your monthly mortgage payment based on your other debts is a bit more completed.

On this page is a 2020 income percentile by state calculator for the United States. If you make more than a certain amount youll be on the hook for an extra 09 in Medicare taxes. Next select the Filing Status drop down menu and choose which option applies to you.

Our calculator has been specially developed. Use our DTI calculator to see if youre in the right range. There is no income limit on Medicare taxes.

This calculator is intended for use by US. US Income Tax Calculator 2021 The Tax Calculator uses tax information from the tax year 2021 to show you take-home pay. Simply enter your annual earning and hit Submit to see a full Salary after tax calculation for any State in the United States.

It contains the most recent data through 2021. Zillows mortgage calculator gives you. More information about the calculations performed is.

Texas Salary Tax Calculator for the Tax Year 202122. First enter your Gross Salary amount where shown. How to calculate mortgage payments.

See where that hard-earned money goes - with Federal Income Tax Social Security and other deductions. If you make 55000 a year living in the region of New York USA you will be taxed 12213That means that your net pay will be 42787 per year or 3566 per month. Contact credit center for income variances questions and or precise figures.

This is handy if you are flicking between different web pages andor apps as it allows you to focus on the tax calculator without. Using a 30 hourly rate an average of eight hours worked each day and 260 working days a year 52 weeks multiplied by 5 working days a week the annual unadjusted salary can be calculated as. 30 8 260 62400.

Calculated figures are for reference only. It can also be used to help fill steps 3 and 4 of a W-4 form. Optionally plot income distribution for other ages using the pull-down menu.

The United States Monthly Tax Calculator for 2021 can be used within the content as you see it alternatively you can use the full page view. You are able to use our Texas State Tax Calculator in to calculate your total tax costs in the tax year 202122. Heres a breakdown of.

It works for either individual income or household income or alternatively only to compare salary wage income. Your debt-to-income ratio helps determine if you would qualify for a mortgage. Take-Home-Paycheck Calculator Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary.

145 of each of your paychecks is withheld for Medicare taxes and your employer contributes another 145. Calculating estimated earnings of your passive incomes - for mobile advertising incomes and others. On this page is an individual income percentile by age calculator for the United States.

If you are paid in part based on how many days are in each month then divide your annual salary by 365 or 366 on leap years then multiply that number by the number of days in the month to calculate monthly salary. Using the United States Tax Calculator is fairly simple. Most lenders do not want your total debts including your mortgage to be more than 36 percent of your gross monthly income.

Enter pre-tax income earned between January and December 2019 and select a state and income type to compare an income percentile. Monthly Income Calculators Version.

Monthly Income To Hourly Wage Converter Monthly Salary Paycheck Conversion Calculator

Budget Calculator Budget Planner Mls Mortgage Budget Calculator Mortgage Amortization Budgeting

New Tax Law Take Home Pay Calculator For 75 000 Salary

How To Calculate Gross Income Per Month The Motley Fool

How To Calculate Your Paycheck Protection Program Loan Amount Bench Accounting

Federal Income Tax Calculator 2020 Credit Karma

Income Tax Calculator Calculate Income Tax Online Fy 2020 21

Online Income Tax Calculator Calculate Income Taxes For Fy 2020 21 Scripbox

80 000 After Tax Us Breakdown July 2021 Incomeaftertax Com

Income Percentile Calculator For The United States

Annual Income Learn How To Calculate Total Annual Income

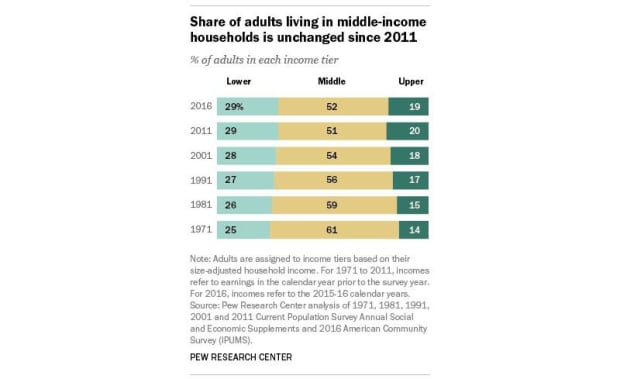

What Is The Middle Class Income And Range Thestreet

Salary Calculator Convert Wage Into Hourly Monthly Annual Income

Free Budget Spreadsheets Net Worth Calculator Usa Budgeting Worksheets Personal Budget Personal Budget Template

Income Tax Calculator Calculate Income Tax Online Fy 2020 21

Post a Comment for "Monthly Income Calculator Usa"