Salary Meaning For Pf

If a salaried employee works a bit more or less in any given week it isnt. Through a provident fund PF you contribute a part of your salary each month towards the pension fund.

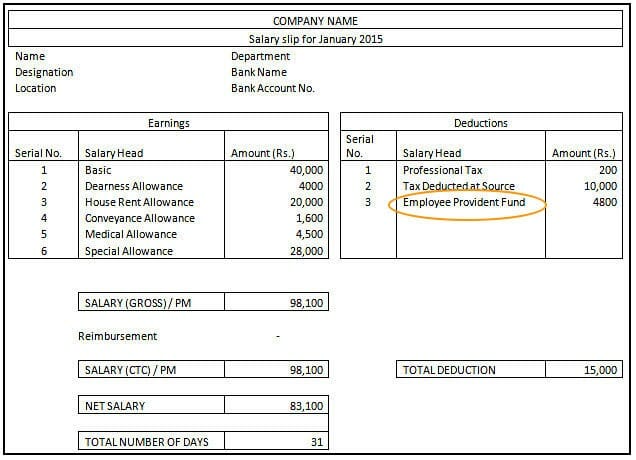

Simple Salary Slip Format For Small Organisation In Excel Format

Rules related to Employee Provident Fund EPF Just like the ESI scheme the Employees Provident Fund EPF is a Contributory fund with contributions from both the employee and their employers.

Salary meaning for pf. More contribution of Rs1920 but. An online transfer facility is available where an employee can transfer his or her provident fund EPF balance with the previous employer to a new employer with ease. For PF contribution the salary comprises of components such as.

Earlier Form 13 was required to be filled out signed by. A wage or salary based on the cost of living and used as a standard for calculating rates of pay. In our opinion those wages.

All the rules and regulations are defined by the Employee Provident. This means that even if the employees salary is above Rs 15000 the employer is liable to contribute only on Rs 15000 that is Rs 1800. While the focus of the ESI scheme is healthcare Provident Fund is focused towards post Retirement Income and Benefits.

I would like to seek your expert view on the issue that we are currently dealing. As per our current practice we were deducting PF on the max. But from now onwards it includes BasicDAAllowances.

For the PF deduction the maximum limit of salary of the employee is Rs 15000 per month. The amount collected in the EPF account is provided to the employees after they retire. Basic wages DA conveyance allowance and special allowance.

That annual salary is divided between the employers pay periods for the year and the employee receives the same gross amount every paycheck unless something changes like a pay increase. Basic Salary Dearness Allowance DA and Commission if paid as percentage of turnover. As an employee provident fund PF contribution is a part of your salary and you can see how much goes into it from your monthly salary slip.

It is paid either as a consolidated wage or bifurcated into various Allowances. How to check eligibility for online PF transfer. Effects of Supreme Court Judgement in the matter of Surya Roshini Ltd Dated 28-02-2019.

If the salary basic wage DA of an employee is 15000 from the starting date of his joining then it is not mandatory to deduct PF from his salary. There was a debate on whether the other components of salary allowances perquisites and reimbursements. Meaning the minimum criteria or salary for which deduction under EPF is being done should be increased to Rs.

Provident fund contribution is mandatorily either of the following. Posted by Team Proactly. The amount accumulates over a period of time and you get it as a lump sum upon retirement or at the end of the employment.

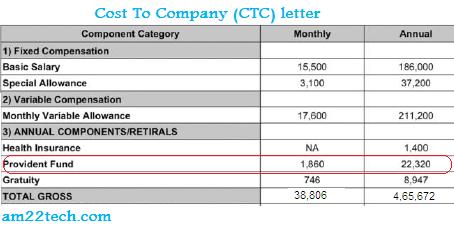

Provident fund is an investment both by the employer and the employee each month the lump sum amount of which acts as an employees retirement benefits scheme. Wages or Salaries are emoluments earned by an employee. Contribution to EPF will be 12 of Rs46000 which is Rs5520.

When an expression is not defined one can take into account the definition given to such expression in a statute as also the dictionary meaning. Apparently Bharatiya Mazdoor Sangh BMS has urged the government not to deduct PF of those persons whose monthly salary is Rs 15000. They said the deduction as per Employees Provident Fund EPF should be done for those persons receiving Rs 21000 as monthly salary.

Every setup with more than 20 employees or more has to offer PF to its employees. PF Deduction on Salary above 15000. Salaried employees may be required to punch a time clock but their pay isnt tied to the hours on their time card.

And the PF is calculated on 15000 only. Definition Of Salary For PF. While the salary structure was designed to align with the Income tax law it was not aligned to the PF law.

In 1952 the PF Provident Fund or EPF scheme was introduced under the Employees Provident Fund and Miscellaneous Act. However as per new PF enhancement now PF. With recent amendment Employess with salry less than 15K are mandated to contibute to PF if number of.

Accordingly Employers followed the practice of splitting the total salary into various components like basic salary allowances perquisites and reimbursements. Previously as the meaning of salary was only BasicDA so 12 of Rs30000Rs3600 was considered for EPF payout from your end and equally from your employer end too. The EPFO does allow transferring funds under certain protocols.

Some for the popular or. In this process an amount is deducted from their monthly salary and is put into the EPF account. Employee Provident Fund EPF To calculate the salary components under employers contribution towards the provident fund one has to consider the same salary components of HRA ie.

So your total salary from above example will be Rs46000. A rate of pay for a standard work period exclusive of such additional payments as bonuses and overtime. All allowances under question are PF wages The salary structure and components of salary were examined on facts by the authorities who have arrived at a conclusion that the allowances in question were essentially a part of the basic wage camouflaged as part of the allowance to avoid PF contributions.

To get a detailed breakup you need to get your hand on a copy of the PF statement where you will find information of both employee and employer contributions and other details including interest earned during the year in a consolidated form. PF deduction on Gross Salary Supreme Court Decision. The employee can get his transfer claim attested by either of his employer.

Definition Of Basic Salary For The Purpose Of Pf - PDF Download. If the employee salary increases to above 15000 due to salary hike and if he is previously an EPF member then he should continue making PF contribution. Kapish Saluja Labour Law Consultant Mumbai.

Part -1 of 2.

Salary Slips In 2021 How Do They Work Samples Tax Deductions Components Scripbox

Pf Calculation On Salary How Epf Is Calculated Abc Of Money

Download Salary Breakup Report Excel Template Exceldatapro Payroll Template Breakup Excel Shortcuts

How Epf Employees Provident Fund Interest Is Calculated

Pf Esi Calculation Excel Format 2021 Download

How To Calculate Pf And Esi With Example In 2018

Epf Interest Rate 2020 21 How To Calculate Interest On Epf

Epf Vs Ppf Vs Vpf Ctc And Salary Slip India

How To View Epf Passbook And Track Contributions Interest Transfer Withdrawal

How To Calculate Provident Fund Calculator Galaxy Phone

What Is The Pf And When It Is Deducted From The Salary Quora

Is It Mandatory To Deduct Pf From Salary More Than 15000

Download Salary Sheet With Attendance Register In Single Excel Template Exceldatapro Attendance Register Salary Excel Templates

Employee Provident Fund Epf Changed Rules From 1st Sept 2014 Sap Blogs

New Wage Code How Your Salary Structure Will Change Businesstoday

What Is Salary Slip Definition Importance Components And Format

Established In The Year 2004 Shree Balaji Management Consultants Sbmc Is Engaged In Pro Soft Skills Training Training And Development Performance Appraisal

Pf Calculation On Salary How Epf Is Calculated Abc Of Money

Post a Comment for "Salary Meaning For Pf"