Monthly Payroll Tax Calculator Qld

Calculate your monthly payroll tax The 2021 Annual reconciliation is now available. If you employ working holiday makers other tax tables apply.

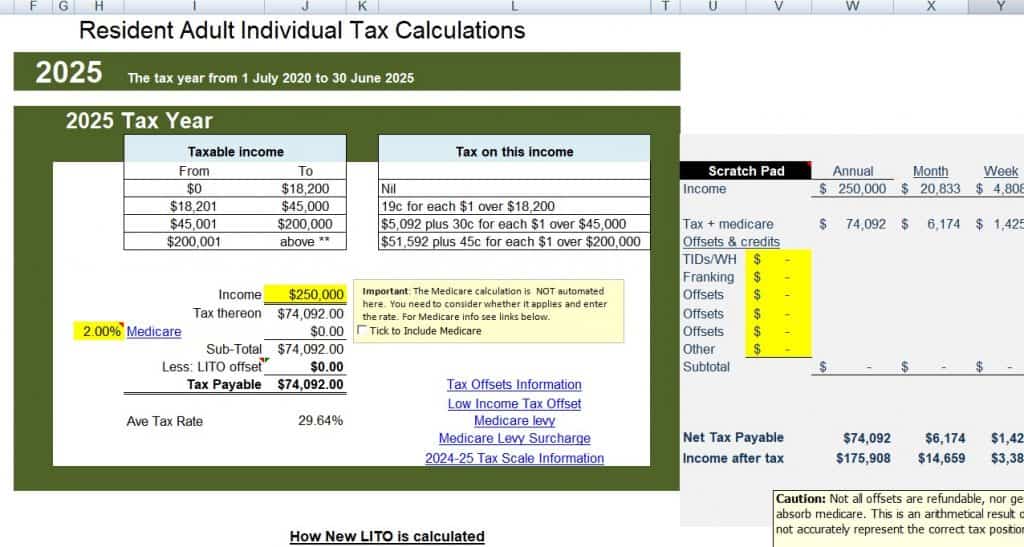

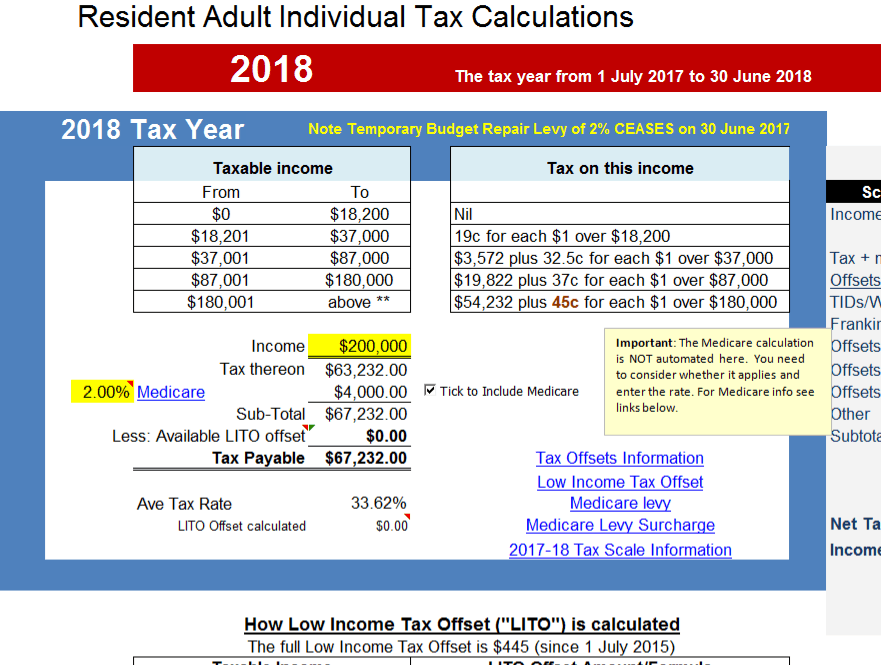

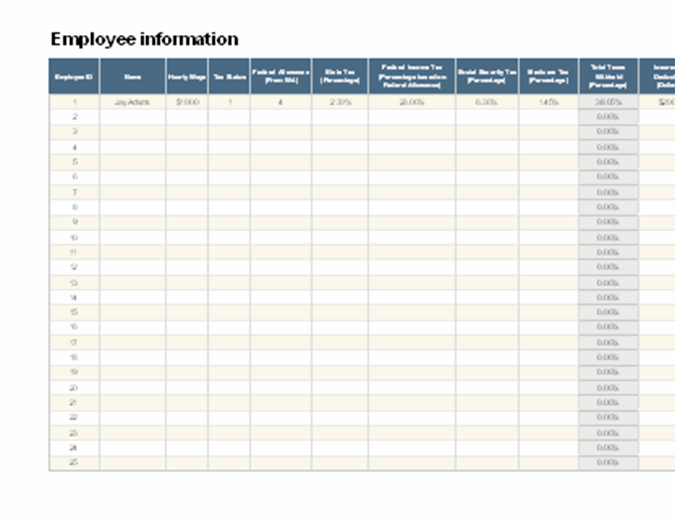

Australian Tax Calculator Excel Spreadsheet 2018 To 2025 Atotaxrates Info

2020-2021 pre-budget reflects the tax.

Monthly payroll tax calculator qld. You can also use our periodic liability calculator to work out your payroll tax for each return period. Terms used in the calculator. Fixed periodic deduction payroll tax calculator help.

Payroll tax liability and taxable wages Understand payroll tax liability and taxable wages when you operate a business in Queensland. JobKeeper payments are exempt from payroll tax. You can use our calculators to determine how much payroll tax you need to pay.

Enter the relevant data and click Calculate to determine your liability. It will confirm the deductions you include on your official statement of earnings. The ATOs tax withheld calculator applies to payments made in the 202122 income year.

If you are using the Pay Calculator as a Monthly Fortnightly or Weekly Wage Calculator you will need to consider the total amount earned for each period and how this might alter your tax rate. For the 2016-17 financial year the marginal tax rate for incomes over 180000 includes the Temporary Budget Repair Levy of 2. Calculating payroll tax You can work out how much payroll tax you need to pay that is your payroll tax liability by using this formula.

For information about other changes for the 202122 income year refer to Tax tables. Accountants bookkeepers and financial institutions in Canada rely on us for payroll expertise and payroll services for their clientele. Select the return period.

In most cases your employer will deduct the income tax from your wages and pay it to the ATO. This example uses monthly. Emphasized Previous Action Next Action Positive Action Negative Action To open menu press F4 Press Enter to trigger action and Arrow Down to open menu Split Button To edit title press F2 To lock title press Enter To open list press F4.

Budget 2021-22 update This calculator has been updated with tax changes set out in the 2021-22 Budget. However by using ATO tax tables your employer will deduct 732 per month if salary is paid monthly and in total 8784 during financial year 12 x 732. Trusted by thousands of businesses PaymentEvolution is Canadas largest and most loved cloud payroll and payments service.

If you pay payroll tax monthly and your taxable wages for the month are less than 541666 calculate your deduction as shown. Annualfinal liability payroll tax calculator help. The 2021-22 monthly calculator will.

Calculate your liability for periodic annual and final returns and any unpaid tax interest UTI. Fixed periodic deduction start date. 475 for employers or groups of employers who pay 65 million or less in Australian taxable wages.

You assume the risks associated with using this calculator. The difference is 237 and thats what you are going to get back assuming you had no more income or work related expenses. This is a valuable resource for individuals paid a commission for sales or who work overtime as you can use the wage calculator to understand how your Take Home Pay may vary based on fluctuations in your earnings.

Enter the payroll tax for the period Enter the amount of payroll tax liability calculated on your Queensland taxable wages in accordance with the Payroll Tax Act 1971. The payroll tax rate is. Total Queensland taxable wages - Deduction Payroll tax rate Payroll tax liability.

This includes the extension of the Low and Middle Income Tax Offset LMITO for the 2021-22 tax year. The Queensland Government has announced changes to payroll tax rates and thresholds from 1 July 2019. Below is the table what you could get back based on your pay frequency.

Enter the relevant data and click Calculate to determine your periodic liability. Use this calculator to quickly estimate how much tax you will need to pay on your income. 495 for employers or groups of employers who pay more than 65 million in Australian taxable wages.

The calculator helps you calculate your fixed periodic deduction for payroll tax. The calculator helps you calculate your periodic payroll tax liability. These calculators are for information purposes only.

Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions. Terms used in the calculator. Click Calculate to display unpaid tax interest details.

The calculator helps you to self-assess your annual or final payroll tax liability. To select press spacebar To deselect press spacebar To enter press tab key. This calculator is always up to date and conforms to official Australian Tax Office rates and formulas.

To assist customers with the impact of COVID-19 the due date for lodgement and payment of the 2021 annual reconciliation has been extended to 30 August 2021. The Queensland Government has announced changes to payroll tax rates and thresholds from 1 July 2019. Select the return type Choose the return type from the drop-down list.

Enter the date your payment will be received by us. Payroll Calendar For Public Servants Qld By airi Posted on January 5 2021 April 6 2021 Payroll Calendar For Public Servants Qld Payroll used to be simple instead daunting monthly procedure calculating deducting and detailing an employees Tax obligation and. Periodic liability payroll tax calculator help.

To select a different item use up and down arrow keys. Enter the relevant data and click Calculate to determine your fixed periodic deduction.

Payroll Tax Deductions Business Queensland

Home Loan Deposit Calculator Home Loans Home Renovation Loan Home Improvement Loans

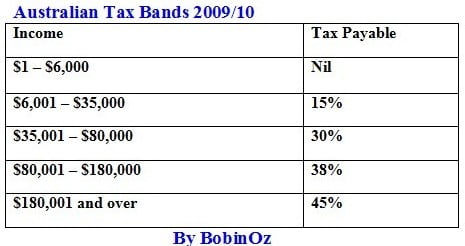

Cost Of Living Australia Income Tax Rates By Bobinoz

Australian Tax Calculator Excel Spreadsheet 2018 To 2025 Atotaxrates Info

Aus Processing State Payroll Taxes For Australia

Payroll Tax Deductions Business Queensland

Payroll Tax Deductions Business Queensland

Aus Processing State Payroll Taxes For Australia

How To Pay Your Nanny S Taxes Yourself Nanny Tax Nanny Payroll Payroll Template

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Payroll Taxes

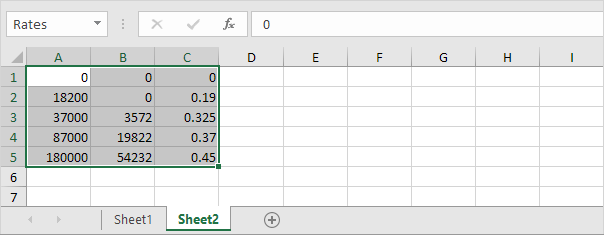

Tax Rates In Excel Easy Excel Tutorial

Cryptocurrency Taxes In Australia 2020 2021 Guide Cointracker

Paycheck Calculator For Excel Paycheck Consumer Math Salary Calculator

Tax Calculation Spreadsheet Spreadsheet Business Tax Excel Spreadsheets

Cryptocurrency Taxes In Australia 2020 2021 Guide Cointracker

Aus Processing State Payroll Taxes For Australia

E Tax Depreciation Schedules Australia Can T Avoid Being Australia S Driving Firm Who Give The Best Cost Cheapening Organization Etax Tax Deductions Appraisal

Use This Sales Tax Calculator To Figure Sales Tax Or Vat Gst At A Rate Of 15 Free To Download And Print Sales Tax Calculator Tax

Post a Comment for "Monthly Payroll Tax Calculator Qld"